student loan debt relief tax credit for tax year 2021

CuraDebt is an organization that deals with debt relief in Hollywood Florida. The application went online at StudentAidgov on.

President Biden Extended The Student Loan Payment Freeze Until May 2022 Nextadvisor With Time

Have incurred at least 20000 in undergraduate andor graduate student loan.

. The roughly 45 million Americans with student loan debt likely felt great relief on Aug. About the Company Student Loan Debt Relief Tax Credit For Tax Year 2021. If the credit is more than the taxes you would otherwise owe you will receive a tax.

In some states the answer could be yes. When setting up your online account do not enter a temporary email address such as a workplace or. If your MAGI was between 80000 and.

31 2020 to Jan. On Thursday President Joe Biden tweeted that about 26 million people already applied for federal student loan forgiveness. As a general rule a discharge of indebtedness counts as income and is taxable as my colleague Will McBride explains.

The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. There are a few qualifications that must be met in order to be eligible for the 2021 tax credit. Any new loans disbursed on or after July 1 2022 including loans for the current 2022-2023.

To be eligible for the Student Loan Debt Relief Tax Credit you must. 125000 in 2020 or 2021 as a single. The total amount of the credit claimed shall be recaptured if you dont use the credit for the repayment of the undergraduate student loan debt within 2 years.

One begins to lose rest and feels pressured. It includes both required and voluntarily pre-paid interest payments. Student loan interest is interest you paid during the year on a qualified student loan.

24 when President Joe Biden announced his student loan relief plan. Millions of student loan borrowers should get onetime student loan debt relief without applying. This application and the related instructions are for Maryland residents.

Student Loan Debt Relief Tax Credit 6 North Liberty Street 10th floor Baltimore Maryland 21201. To claim the full credit in 2021 your MAGI must have been 80000 or less 160000 or less for those married filing jointly. A provision in the March 2021 COVID-19 relief package stipulates that any debt forgiven from Dec.

Do NOT include entire TurboTax packet entire HR Block packet IRS form 1040 form W-2 form. Enter the total remaining balance on all undergraduate andor graduate student loan debt which is still due as of the submission of this application. Were eligible for in-state tuition.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are. Maryland Higher Education Commission Attn. Maintain Maryland residency for the 2021 tax year.

Student Loan Debt Relief Tax Credit for Tax Year 2021 Details Instructions I. Amounts canceled as gifts bequests devises. Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents.

Have incurred at least 20000 in undergraduate. Debt cancellation applies only to federal loans disbursed by June 30 2022. Mhec student loan debt relief tax credit program for 2021.

It was founded in 2000 and is a. What you need to know about the extended student loan. A copy of your Maryland income tax return for the most recent prior tax year.

And how debt forgiveness could impact your credit. You may deduct the.

Student Loans In The United States Wikipedia

Student Loans Who Can Pay Taxes On Forgiven Debt Marca

Which States Tax Student Loan Forgiveness And Why Is It So Complicated Tax Policy Center

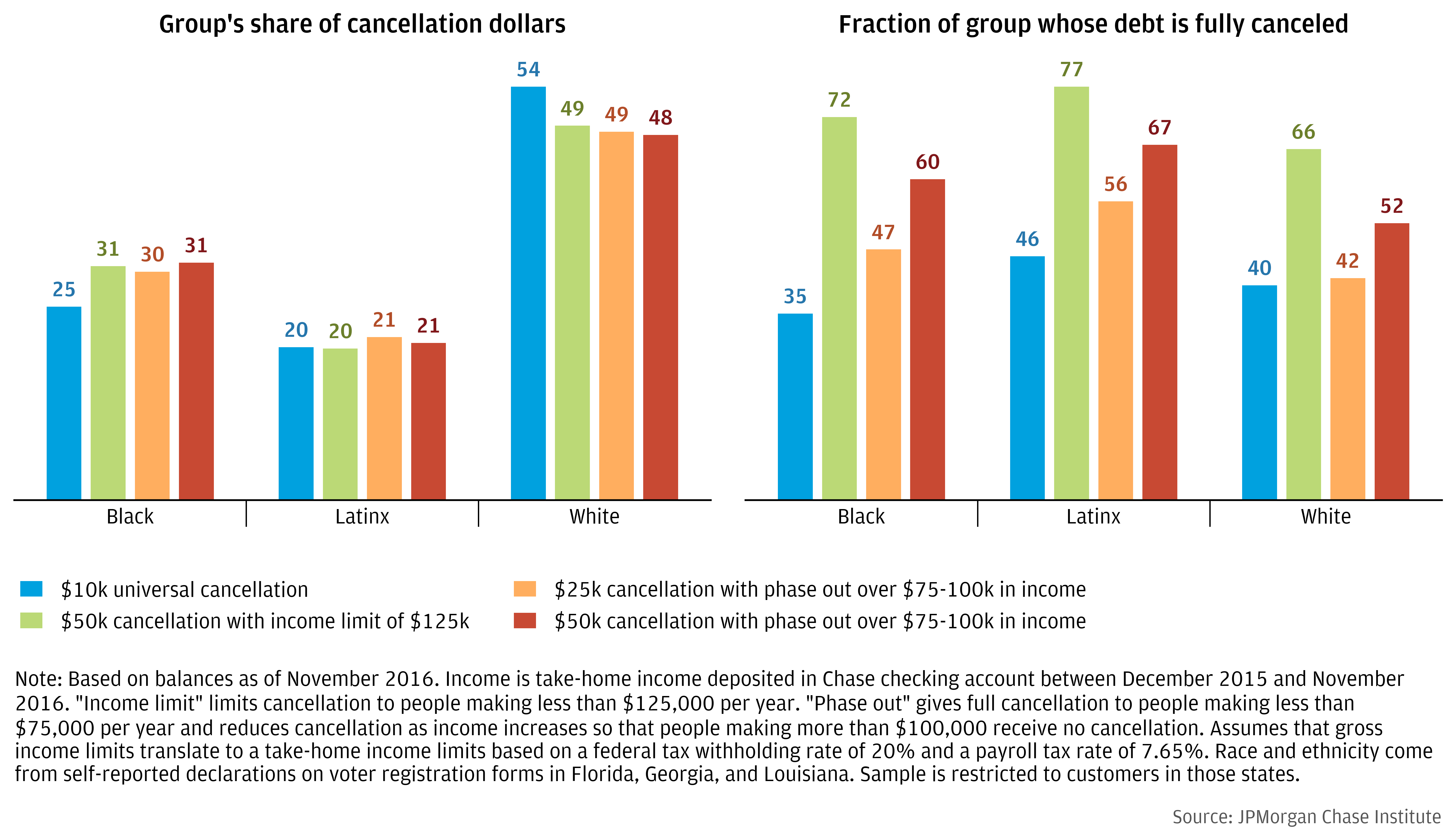

Who Benefits From Student Debt Cancellation

Student Loan Forgiveness Official Application Is Live

Student Loan Debt Forgiveness Faq Who Gets Relief How Much Is Canceled And When Will It Happen Cnet

Who Benefits From Student Debt Cancellation

Comptroller Implores Marylanders To Apply For Student Loan Tax Credit Afro American Newspapers

Mississippi Plans To Tax Student Debt Relief But Paycheck Protection Program Loans Are Tax Exempt Mississippi Today

Biden Administration Previews Student Loan Forgiveness Website Cnn Politics

/cdn.vox-cdn.com/uploads/chorus_asset/file/23968591/student_loan_debt_forgiveness_board_1.jpg)

What Student Loan Forgiveness Means For You Vox

Covid 19 Emergency Relief And Federal Student Aid Federal Student Aid

Some States Could Tax Biden S Student Loan Debt Relief Boston News Weather Sports Whdh 7news

Private Student Loan Forgiveness Alternatives Credible

See How Average Student Loan Debt Has Changed In 10 Years

Can Debt Forgiveness Cause A Student Loan Tax Bomb Turbotax Tax Tips Videos

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Putting Student Loan Forgiveness In Perspective How Costly Is It And Who Benefits

Howard County Executive Calvin Ball Do You Have Student Loans Maryland Taxpayers Who Have Incurred At Least 20 000 In Undergraduate And Or Graduate Student Loan Debt And Have At Least 5 000 In